Economic experts did not cover themselves in glory during the financial crisis of 2008. They had been issuing growth forecasts, some clearly grotesque in hindsight, up to the very eve of the crisis; such forecasts were so widespread and, once the crisis broke, so obviously baseless, that so-called “mainstream economics” was caught in a crisis of legitimation and took some time to recover its voice. Other voices had been warning for a while that something was amiss in economic and financial sector, especially in the United States, and all of a sudden it appeared that they had been right.

It seems to be the way of things that prevailing opinion is wrong, and that more accurate expertise is ignored. At least that is what the historical evidence would suggest. Yet despite all this, economic expertise thrives. One might assume that the attraction of its arguments and predictions has nothing to do with its accuracy. It sometimes seems that expert opinion is sought out independently of whether it is right. At least insofar as politics itself is often far from equipped to give a competent assessment of economic affairs, but still needs backing from experts so that political goals and priorities appear economically feasible. If the desired effects don’t come about, then the experts are replaced and new wisdom is sought – but the post of expert never goes unfilled.

For the expert, the situation can be fatal. When expert advice fails, it has consequences for individual experts; yet the failure of any single expert doesn’t necessarily reflect on the school of thought he or she represents. Economics “wonks” have a doubly risky job; on the one hand they can be proven wrong themselves, and on the other hand the school of expertise that they stand for may be wrong, or be seen as being wrong. Sometimes both of these things happen at once – although usually not. All of this has a bearing on how experts and expertise are perceived: the more radical and far-reaching the advice offered and the more sweeping the expert’s claims, the greater the risk of failure – especially when, as so often, the advice given goes hand-in-hand with a forecast. It is helpful at this point, then, to cast an eye over the history of economic expertise.

The birth of the expert

The problem is first of all a fundamental one. States (or in earlier times rulers) are limited in their actions by the economic resources at their disposal, and can only produce a fraction of these for themselves. They must tap resources from the economic productivity of their citizens (or subjects), but have only a limited influence over this. The more resources states lay claim to, the more acute the problem becomes; there is a real risk that they will tax economic productivity to such an extent that, in the end, it ruins the basis of their ability to act. Charles Tilly has identified three mechanisms within the European tradition whereby rulers and sovereigns have sought to get hold of money: by coercion, voluntary contribution or some mixture of the two. Empires tend toward plunder, city-states toward more voluntary forms of self-administration and payment of dues, while territories somewhere in between, as most European polities were, tend toward a mixture of coercion and self-administration.

It would be putting it mildly to say that the ruling powers’ relation to money was prone to dispute; accordingly, the need for competent advisors arose, varying according to how resources were extracted. A regime based on plunder could get by without expert advice, or at least without advice of an economic nature, but would generally only be rewarding in the short term. A more sustainable approach to any given territory’s resources had a much better chance of success. Hence, from the late Middle Ages at the latest, princely advisers pop up in most European territories, tasked with administering the ruling power’s revenues and advising on how they could be increased – whether by developing more effective forms of taxation, by tackling debt, or by negotiating tax policy and rates of taxation with representatives of the estates, at various levels in the Empire and in individual states. At the same time, there was an increased need for competent administrators for the princely court and tax revenue offices.

Certainly such “expertise” was available even in the Early Modern world, but it was very different from what we would understand by the term today. While the initial goal was to increase princely revenues and to improve fiscal administration, gradually the realization dawned – in Germany this happened in the latter seventeenth century – that the real question wasn’t about the efficient extraction of resources but the resources themselves.

The focus shifted from raising taxes to promoting the economy. It became generally recognized that the ruling power could only act when the land as a whole was flourishing.

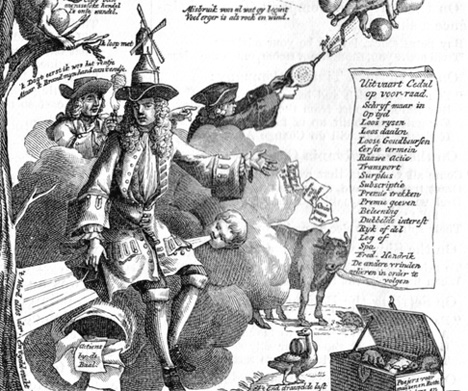

Advisers offering their services to princes in the seventeenth and eighteenth centuries, most of them with “projects” to promote, promised that their targeted interventions would increase the country’s wealth. For them, any advantage to the princely court was merely an indirect argument. They included count Johann Joachim Becher in Vienna, or the most famous “projector” of the time by far, the Scotsman John Law, who set out to revolutionize the financial system of the Kingdom of France. Even then, their projects rested on the basic assumption that the economy had its own rules and that the penalty for ignoring these was a drop in revenues. Certainly, there was still a long way to go before experts could claim to speak in the name of an autonomously functioning system called “the economy”. But the first step had been taken. Above all, these early experts formulated a political doctrine that advised princes on how to improve the economic productivity of their territories through targeted interventions (including trading privileges, the promotion of exports, imposition of customs, building roads and canals, and agricultural improvements). The eighteenth-century German cameralists already had a very clear idea of “economic laws.” However, their underlying assumption was always that, within these laws, the state was to play the benevolent role of patron, protector and encourager. The advice given by Johann Heinrich Justi and Joseph von Sonnenfels to the Prussian and Austrian governments respectively reflected these ideas, and the states willingly followed that advice – in part.

Admittedly, the results of such mercantilist – or cameralist – government patronage were patchy at best. Most crucially, the tax system, and administration of state debt, remained inefficient. This epoch saw the birth of the expert as such and of the first modern forms of economic expertise, though it was by no means a straightforward process; several factors had to fall into place. On the one hand, an autonomous body of economic theory had to be formulated – to use Niklas Luhmann’s terms, a particular system had to be developed with which to observe and describe the economy. On the other hand, this theory had to be formulated in such a way that it could also serve to frame normative recommendations to policy-makers. Thus it had to be descriptive and at the same time normative in its description. Economic theory has had this hybrid status ever since, in that it is both academic analysis and form of applied wisdom. Both factors had to be in place before we can talk of expertise as such.

The rise and fall of liberalism

Depending on the configuration of description and normativity, economics is more or less suited to particular forms of expertise.

This composite character is expressed in the term “political economy,” coined in the eighteenth century and readily understandable well into the nineteenth. In other words, modern expertise demands knowledge of the “laws of economics”, which are acquired by theoretical reflection, and that these laws be communicated to the political system. Expertise then becomes a normative formulation explaining how laws are to be followed in order to guarantee political success – measured in terms of increase in resources and prosperity. Here, the expert’s role in the process of political communication is to formulate the autonomous economic argument as impulse for political decision-making.

The first of these economic sages was François Quesnay, who developed the theory of physiocracy. In his Tableau économique, Quesnay wished to show that the economy formed a closed, quasi-natural cycle that was most efficient when operating autonomously under its own laws and not disturbed or obstructed by arbitrary state intervention: Laissez faire, laissez passer! For Quesnay, agriculture was the dynamic, value creating moment of this economic cycle, and thus the only area that needed to be taxed. The whole, complicated system of taxation, privileges, and economic and trade policy ought, he argued, to be abandoned and replaced by a liberal policy imposing a flat rate of tax on agricultural productivity, from which nobody would be exempt.

Given the fact that the French state was heavily in debt and the difficult economic situation, Quesnay found a sympathetic audience. Jacques Turgot, the French finance minister from 1774 to 1776, attempted to at least experiment with part of his physiocratic doctrine, but failed because of resistance from the representatives of the old economy of privilege, who could only lose out from a policy of state austerity and impartial, comprehensive taxation on agricultural yield. Bad harvests and rising bread prices played their part in undermining Turgot’s position. He was eventually pushed aside, even though – or possibly because – he was the first to try to formulate economic policy on the basis of expertise. The extent of his commitment to the principles of physiocracy is arguable: English influences can also be detected. Whatever the case, after Turgot’s downfall the French government returned to the disastrous economic and financial policy that, together with harvest failures and rising living costs, created the background for the revolutionary events of 1789 onwards.

The best-known economic expert of the day, Adam Smith, was spared such ignominy. However it is an open question whether he was an expert in the full sense. He never personally brought his arguments into the arena of politics. Rather, with his concept of a self-regulating economy within the frame of free competition, Smith revolutionized economic analysis, and with it the basis for all future economic policy. Where the state had previously been seen as the guarantor of social integration and economic efficiency, Smith shifted the emphasis. From now on, economic efficiency and social integration were, by their very nature, givens; the state’s task was to support and ensure this natural order of things. It was only to intervene when competition and self-interest failed to provide the results required, for example in education, defence or road-building. The extent of the success of Smith’s counter-theory and his influence over economic expertise in the next few decades can be seen in the Prussian reforms of the years following defeat by Napoleon. The abolition of serfdom and the liberalization of trades from guild monopoly in Prussia between 1807 and 1811 was the work of civil servants schooled in Adam Smith. Smith’s liberal dogma of a self-correcting economy primarily justifies measures doing away with mercantilist privilege and trade barriers. When the market economy is functioning as it should, however, there is no need for further expertise.

It wasn’t only the Prussian reforms that bore Smith’s influence: nineteenth-century economic policy as a whole was infused by the spirit of liberalism. In this climate, there was simply no need for expertise, at least not from the viewpoint of liberal economics. In some projects, such as England’s transition to free trade or the implementation of the gold standard, economic expertise, or certain economic approaches, indeed claimed a place. Here, liberal economists took part in public debates, setting the tone for discussion and enjoying great success, as the case of David Ricardo clearly shows. However, what is surprising about developments in the first half of the nineteenth century is something else. Generally speaking, when economies run into difficulty, dominant models of economic thought and ideas about how to shape economic policy find themselves on the defensive, not to say in crisis, and lose their influential position. Yet liberalism remained the prevailing, mainstream view of how the economy functioned right through to the 1870s.

The years between 1815 and 1848 were anything but economically brilliant: crises, bad harvests, famine and mass suffering came thick and fast, sometimes in the most dramatic fashion. Predictably, there were a number of rival attempts to envision a different economy, a different form of social organization and a different role for politics, but their proponents – the counter-experts of the time – failed, at least in practical terms. This is as true for the early socialists around Saint-Simon and Charles Fourier as it is for Karl Marx, for artisanal socialism (Handwerkersozialismus) and for the neo-mercantilist proposals of Friedrich List, whose ideas for a consciously statist developmental policy found numerous followers in Germany and the United States but failed to translate into practice. Nonetheless, List did contribute to the USA’s decision not to embrace free trade but to maintain an effective customs barrier.

Even when the liberal paradigm took a knock after the panic of 1873, little changed in the expert consensus of non-intervention. The economists Carl Menger and Gustav Schmoller may have disagreed loudly about the proper foundation for economic policy and decision-making (the so-called Methodenstreit), however this did not accompany any greater engagement on the part these experts. Schmoller and the association he founded, the Verein für Socialpolitik, certainly saw themselves as experts in what they considered to be an appropriate state economic and social policy, however the argument that subsequently broke out showed that they would have a hard time giving clear advice. Although Bismarck’s social policy profited from guidance and expertise from the circle around Schmoller, the Verein held back from any active political advisory role.

By far and away the most influential German economist in the decades before the First World War, Schmoller placed his trust in an historically-aware and enlightened bureaucracy trained and, when necessary, advised by him. It was not his place to make or influence decisions, or to demand a particular course of action. The liberal economist Moritz Julius Bonn, who had attended Schmoller’s lectures before the war, later accused him of being a “relativist”: “He seldom said either yea or nay. He taught his students to regard all economic problems as shapeless, ever-changing phenomena whose true nature could never be fathomed. The best approach, he said, was to study their history; an economist who was particularly bold, brash and enquiring might go as far as to describe current conditions, but should never draw any conclusions about them. As for economic policy, the wisest course of action was inaction, leaving policy to the government of the day, and once the government had reached a decision an economist could find relevant facts and good reasons to support it.”

If this type of expertise had not been enough for younger economists even before 1914, the war seemed to sound the knell for the privy council-style of political advice. The demands of a wartime economy followed by the crises of the inter-war years radically changed expectations of what state economic policy could and should do, altering the role of the advisor in unforeseen ways. When Joseph A. Schumpeter, who later in life declined any kind of active political involvement, took part in the Austrian nationalization commission (Sozialisierungskommission), he cynically remarked that it makes sense to have a doctor on hand when attempting suicide. While liberalism still provided the basic template for mainstream economic thought right up until the Great Depression, the question of the role of the state and the potential of a politically determined economy became increasingly pressing. The situation became especially fraught in Germany, since liberalism and Schmoller’s Kathedersozialismus (known as the historical school of economics) had provided no “toolkit” to which the experts could have recourse. After 1918, economists were either at a loss as to what action they should recommend, or became entangled in such vehement arguments about their various ideas that no positive conclusion could be reached. In the worldwide economic crisis after 1929, economic expertise (at least in Germany) found itself in complete disarray, since its pronouncements no longer seemed to apply to economic reality. Instead, all kinds of alternatives to liberal capitalism came out of the woodwork, some of them very odd indeed.

The hour of interventionism

The crisis was not an exclusively German phenomenon, even if from the Anglo-Saxon perspective German economists were seen as irrelevant simply because of their impenetrable rhetoric. In England, the dominant neo-classical view, based on the liberal idea of self-correcting markets, was also running up against the economic realities. The rise of John Maynard Keynes to become the Grand Old Man of economics would have been impossible without the crisis of the liberal paradigm in the inter-war years. Indeed, his biography is almost a case study in the problem of economic expertise. On the one hand, he had an academic training in macro-economics at the feet of Alfred Marshall; on the other hand, he worked for the British government from 1914 on practical problems (the Indian currency question, and then later matters of war finance). The suggestion that he was one of the few people able to bridge the gap between political action and economic rationality, thus overcoming a functional division basic to modern society, was a key to his success. In this respect, he was the ideal expert. In the early Twenties, brimming with self-confidence, Keynes declared that, “The economist is not King; quite true. But he ought to be! He is a better and wiser governor than the general or diplomatist or the oratorical lawyer. However, Keynes was far from successful in his first attempts to push through his own recommendations. He resigned from the British delegation to the Versailles peace negotiations in protest at the decisions of the conference, which violated all economic principles, and then launched a mordant attack on the Treaty, calling it fundamentally misguided.

Over the following years too, Keynes was most often in a minority position; British government economic policy in the inter-war years, oriented on the pre-war gold standard, disregarded his proposals entirely. His position only improved after the publication of The General Theory of Employment, Interest and Money in 1936, which introduced new kind of economic analysis providing theoretical and normative justification for an active economic role for the state. The work established a hitherto unimagined importance for the expert in state economic policy, both in theory and in practice.

While academia gave the book a rather mixed reception, economic policy had long adopted Keynes’ doctrine in several countries. The gold standard, and with it liberal economic policy, had been abandoned almost everywhere around the world by the early 1930s. Liberalism seemed to be over and done with, theoretically as well as practically. Keynes provided a solid theoretical foundation for what was happening in practice everywhere. The credit-financed rearmament policy of Nazi Germany was a litmus test for the validity of Keynes’ ideas – and seemed to confirm them. Keynesianism – the term itself shows how quickly an entire school of thought grew from the opinion of a single expert – dominated the post-war years, at least in the form of the neo-classical synthesis, paving the way for the rise of economics as predominant discipline. As Alexander Nützenadel puts it, “The hour of the economists had come.”

None of this applied to West Germany, however. There, people were weary of the state playing too great a role in the economy. Ludwig Erhard, minister of economics under Konrad Adenauer and later chancellor himself, was something of a figurehead for neoliberalism. Erhard was not an expert in the strict sense, since he had neither the necessary academic qualifications nor a professorial profile. Yet as long as the economy was booming and Erhard could open section after section of Autobahn, nobody was much interested, and he could rely on general praise for his economic policy and its underlying doctrine. His halo was then seriously dented by the recession of 1966/67 and by the frankly amateurish economic policy that had led up to it.

Erhard’s downfall sealed the fate of liberal economics in West Germany – at least for the next few years. His successor, Karl Schiller, was a self-assured university professor who considered economic policy to be an applied branch of pure economics. He introduced state-driven, comprehensive taxation in place of Erhard’s doctrine of non-intervention, certain that this was the only appropriate response to the complex structures of a modern economy. Economic development, he believed, could be kept on an even keel through the right kind of policy; it was simply a matter of drawing on judicious expertise to discipline conflicting interests. In 1968 Schiller launched the policy of “Concerted Action”, a quintessentially bureaucratic and institutional expression of Keynesianism with which Schiller intended harmonize conflicting interests. Posing as an economic wizard, he declared that state intervention aimed at creating a “magic square” of growth, price stability, full employment and a steady balance of trade. This even worked: in 1968/69 the trade unions fell in line with wage policy prescriptions for productivity and margins. Alas, the real economy did not play along; the volume of total economic activity, along with inflation, grew at such a rate that the trade unions came off very much the worse.

The 1970s saw a worldwide retreat from such notions of economic expertise. At this point Keynesianism showed its Achilles heel. Under conditions of intense structural change and sinking growth rates, monetary stimulus alone was not enough; instead, national deficits rose and unemployment with them. This prompted the “great sobering up”; liberal experts, who had long been sidelined, once again found their voices being heard in politics. Just as in the post-war years, when the Keynesian position received a boost from the global boom, so the return of liberalism was a result of economic structural change in the 1970s and the failure of Keynesian regulatory policies. In very much the same way, the current financial and economic crisis that began in 2008 has kicked the so-called “neoliberal” conception out of town. Robert Skidelsky’s 2009 Keynes biography bore the triumphant title The Return of the Master and new a work on Karl Marx, no less, sets out to explain why he “was right”.

Tragic figures

Modern economic expertise is a story for itself, then. This type of expertise was born when politics found itself unable to act, or at least to communicate its actions, without some economic argument to back it up. In the first instance, it took aim at what was called the economy of privilege, and with it the inefficiencies of mercantilism. At this stage there was no positive programme. Untroubled by any socialist criticism, expertise consistently advised the state to trust in the economy’s capacity to self-regulate. Success in the economy would increase the state’s prosperity and, with it, its capacity to act. When it failed, this non-interventionist expertise did not fall far – at least there are no records of disgraced or discredited liberal experts from the nineteenth century.

With the First World War and the crisis of liberal expertise, however, John Maynard Keynes was able to formulate an influential counter-school of expertise that changed the situation fundamentally. State intervention was now possible and indeed necessary; expert advisers were asked, if not to take the wheel, then at least to read the map. Economic expertise obtained a new status and was duly institutionalized in the 1960s – a prestige that remained even when the Keynesian model of taxation ran aground in the 1970s. When Keynesianism came crashing down, its failure was measured by the extent of the claims it had formulated. Liberalism never suffered from such hubris, even if its post-war variant tended to make equally sweeping pronouncements: if only the state would act as liberal theory demanded, markets would function perfectly and free of friction. In this respect, the crash of 2008 was no less dramatic than the failure of Keynesianism in the 1970s.

Ever since the First World War, in other words, the pendulum has been swinging back and forth. The status of expertise has been assured since the eighteenth century, but much less sure has been the kind of expertise required. If one ignores fundamental system-critique, which has always existed and which tends to predict the downfall of the system rather than to accompany its functioning, two variants present themselves as solid economic science and compete for the status of privileged political expertise: liberal non-intervention and Keynesian interventionism. Whether or not they are preferred at any one time does not depend solely on academic credibility, even if it plays a significant role. The expert, after all, is someone who wishes to be heard outside academia – where judgements are not passed on the basis of theoretical criteria alone. In politics, the crucial factor is that the advice fits. Expertise has the edge when it seems to be confirmed, or at least not contradicted, by economic realities. As long as this is the case, politics can take its pick. When the realities change, so the scales shift when it comes to choosing expertise. The variants that are no longer (fully) supported by reality are by no means lost entirely, however. Instead, they are consigned to what might be called an expertise storeroom, or the university, where they await rebirth. Life in storage is sometimes rather cosy, but sometimes it is frustrating, so that it can give rise to critical heterodox voices, warnings and apocalyptic forecasts, which normally go unheard, or heard only where one expects to hear them anyway. All there is to do in this antechamber for unconsulted consultants is wait for the next big crisis to cripple – at least for a while – the rival school of expertise.

All in all this is no bad thing for expertise, as long as its proponents are able to use the underground years to fine-tune their theory, with all the resultant revisions and refinements such as neo-Keynesianism, neo-Marxism, neo-liberalism, neo-Ricardianism, neo-mercantilism, etc. Around 1900, Rudolf Hilferding decided that his task was to modernize Marx; in the 1950s and 60s, Milton Friedman was working on reviving liberalism; in the 1980s and 1990s numerous attempts were made to update Keynes. Hilferding’s transformation of “organized capitalism” underwent a revival in the 1920s and at the present moment various neo-Keynesianisms are being discussed. It remains to be seen how the economic situation develops. What does seems certain, however, is that neoliberalism, itself a reformulation of an older liberalism, has been put into storage – from whence it will re-emerge at some point, re-tuned and ready to go.

Economics as a discipline is largely only accepted – outside academia at least – when its claims receive conjunctural and structural confirmation. Otherwise, economics is fairly useless to political communication. In politics, being right but unsuccessful counts for little. The susceptibility of economic expertise to its circumstances reflects back on its basic character as both science and instruction. That it can fail as instruction while explaining the structural shifts responsible for its changing fortunes is an irony of the discipline. Individual experts might perceive this as tragedy: they must propound doctrine with all the conviction they can muster, but at any time can find themselves overtaken by the reality of the economic process. Yet generally, they rarely become aware of the tragic brevity of their time in the limelight. They tend instead either to be politically ambitious or naive – and perhaps this naivety is necessary in order to keep talking. Economic expertise never actually fails, it either fits the situation or it doesn’t. Despite frequently remarking that the advice they give can and does fail, economists tend not to put this down to a structural problem, rather to mistaken expertise or to the idiocies of politics.

The reputation of experts and the importance of expertise have, generally speaking, not suffered from these ups and downs. Politics is well aware of the problems of expertise, but cannot do without it – even if only to score points in appearing competent to the public. This is why credible sources of counter-opinion are well worth taking seriously, most recently in the euro rescue pact. The only possible reaction to such counter-expertise is the appeal to further expert opinion; for a non-expert simply to reject such advice would carry no credibility. Finally, while know by looking at the past that the pendulum of expertise has moved back and forth, we don’t know whether this will necessarily be the case in the future. Politics can hardly decide to restrict itself to observing what happens and calmly watching opinion change. Expert opinion must be taken seriously, even when its fallibility is known. Its status is always precarious, but it is indispensable. After all, experts are the ones who take the greatest risk, protected only by their naivety – or their fee.